Recent research that analyzed digital chatter around core risks impacting private equity firms found that firms’ concerns relating to environmental impacts have grown significantly in intensity. Couple this increased awareness of environmental risk with the need to achieve high returns on an investment and it comes as no surprise that firms are increasingly using alternative approaches, such as the strategic use of insurance, specifically environmental insurance, to simultaneously address risk, improve exit values and actually make risks easier to acquire, own, and eventually sell.

I’ve collaborated with my colleague, Mark Hayes, from our Environmental team within North America Specialty, to explore this topic – why environmental coverage is coming to the fore, the importance of the right risk and insurance partner, and how to utilize the coverage to improve exit outcomes.

No longer the last item on the docket

There are many reasons environmental insurance is more top of mind now than even five or ten years prior. Firstly, lenders are more aware of the different liabilities that exist, in turn raising PE firms’ awareness. Secondly, the way attorneys view and act on environmental risk is shifting. In the past, attorneys would mostly tackle environmental coverage needs as a last item on the docket to get a transaction to go through – not an uncommon PE approach to insurance in general. Now, it is becoming more and more normal in the transactional world to address environmental risks and coverage needs early in the transactional process, which is largely due to changing and increased exposure and associated losses that have been incurred. Attorneys also increasingly realize that environmental insurance can be difficult to secure – and no one wants insurance to hold up a deal – and prioritizing coverage makes the deal process smoother.

Creativity, speed and holistic offerings key to problem solving

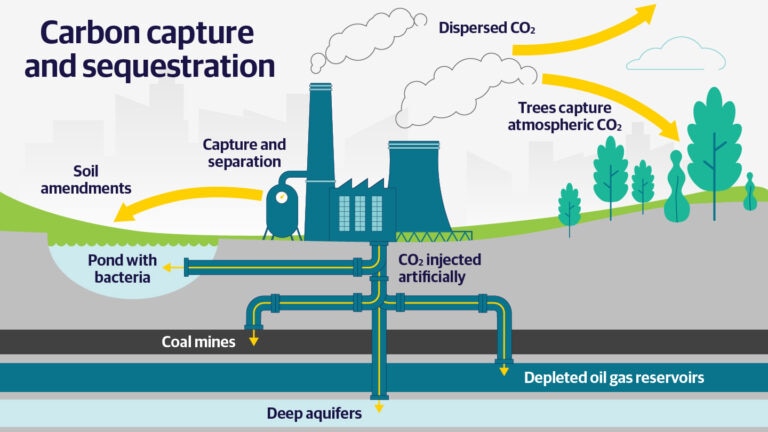

Today’s environmental risks, such as contaminated soil and groundwater, toxic products, hazardous emissions, etc. – and how you insure against them – are growing in novelty and complexity Indeed, addressing tricky environmental concerns can even be the make-or-break factor in completing a transaction. A true underwriting partner understands that any transaction is an opportunity to solve problems and is willing and able to move quickly and think creatively about how to structure risk and the insurance program to that end.

Selecting the best partners to address environmental challenges requires careful consideration. While there are specialty carriers who deal entirely in specialty lines, others, like our teams at Liberty Mutual / Ironshore, take a different approach. A team that has deep relationships in the PE industry and can look comprehensively at all risk and insurance needs and write all lines helps use the scale of the portfolio to impact pricing and losses, mitigate risk comprehensively, and bring creative solutions to the table.

Thinking beyond initial acquisition

It is encouraging to see the PE mindset slowly beginning to shift and think longer-term about how a comprehensive environmental strategy, including insurance, can improve the overall health of the portfolio company for the duration it is held, not just upgrading the risk at the point of sale. This emphasis is beneficial for a firm’s bottom line and ties into a broader public awareness and expectation of ESG initiatives in the industry. Certainly, carrying environmental insurance showcases a commitment to sustainability and risk management, an attribute that is appealing to buyers who prioritize ESG practices in their investment decisions.

Understanding the nuances

Environmental insurance is a broad term. In reality, there are many different types of environmental coverage that PE firms should be familiar with as awareness and momentum grows and they expand their portfolios, including:

- Site Pollution Incident Legal Liability (SPILLS) – helps protect companies from the high clean up and remediation costs following an unforeseen spill or release of hazardous materials, in addition to helping defray the costs associated with third-party bodily injury and property damage claims.

- Environmental Protection Insurance Coverage (EPIC) – a unique combination of general liability, miscellaneous pollution liability, contractors pollution liability, site pollution liability, and professional liability coverage.

- Storage tank liability – coverage that helps protect against environmental risks related to underground and above-ground storage tanks.

- Contractors Environmental Legal Liability (CELL) – provides occurrence-based solutions for a variety of pollution risks facing contractors and consultants. This type of coverage helps manage environmental risks, including third-party bodily injury, property damage, and cleanup after a pollution incident.

Savvy firms seek to learn about these different coverages and have trusted brokers and carrier partners who are open to taking on the role of educator in addition to advisor.

Full speed ahead

Environmental liabilities can have a real impact on a PE firm’s ability to get deals done. With awareness, planning and a solid carrier partner, environmental solutions can be strategically built to ease transactions, improve portfolio values, and boost exit outcomes.

Get in touch

Our commercial and specialty insurance products and services are distributed through brokers and agents. If you are interested in our solutions for your business, please contact your agent or broker. If you are an agent or broker, please reach out to our team for more information.

Rob Langtry

Chicago, IL

Featured insights

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.